Experience Matters. So Do You.

Choosing a mortgage professional is an important decision, and we're honored you're considering Cornerstone Home Lending. Our team will work hard to deliver a satisfying and streamlined lending experience.

About Dan

Dan truly loves what he does. You can see it the second you meet him. With his welcoming personality and genuine thoughtfulness, he quickly connects with each and every client.

Dan also offers trusted insight gained from more than 23 years in the industry. His open communication, clear updates, and prompt responses help clients feel at ease with the process and well-informed at each step. Whether customers are buying their first home, renovating a fixer-upper, or investing in real estate, Dan can easily guide them to a smooth, on-time closing.

Born and raised in Minnesota, Dan graduated from Concordia College with a BA in Communications and Business Administration. He joined the mortgage industry in 1996, and has spent most of his career in private mortgage banking. In 2018, Dan made Cornerstone Home Lending his new professional home because the company’s mission aligns with his personal passion: To make a positive difference in the lives of others.

Outside of work, Dan devotes his time to his wife and their four grown children. When he has some free time, Dan enjoys golf, playing the piano, and officiating high school football games.

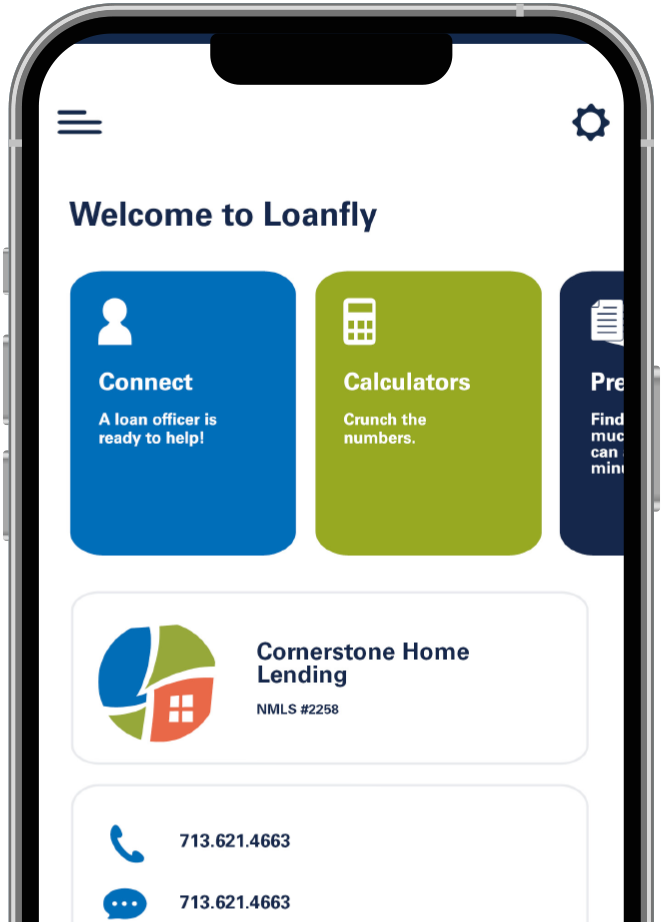

Find Out What You Qualify for in Minutes

Mortgage Payment Calculator

Principal & Interest

$1,083

Taxes

$507

Mortgage Insurance

$73

Home Owners Insurance

$108

HOA

$100

| Purchase Price | Loan Amount | 4.50% | 4.75% | 5.00% | 5.25% | 5.50% | 5.75% |

|---|---|---|---|---|---|---|---|

| $225,000 | $213,750 | $1,838 | $1,903 | $1,936 | $1,969 | $2,002 | $2,036 |

| $235,000 | $213,750 | $1,871 | $1,903 | $1,936 | $1,969 | $2,002 | $2,036 |

| $245,000 | $213,750 | $1,871 | $1,903 | $1,936 | $1,969 | $2,002 | $2,036 |

| $255,000 | $242,250 | $2,093 | $1,903 | $1,936 | $1,969 | $2,002 | $2,036 |

| $265,000 | $242,250 | $2,093 | $1,903 | $1,936 | $1,969 | $2,002 | $2,036 |

| $275,000 | $242,250 | $2,093 | $1,903 | $1,936 | $1,969 | $2,002 | $2,036 |

| $275,000 | $242,250 | $2,093 | $1,903 | $1,936 | $1,969 | $2,002 | $2,036 |

| Cost of Waiting | $36 | $73 | $110 | $148 | $186 | ||

Contact Dan